Highly rated global insurance firms today guarantee reclamation of most western coal mines, but that may change.

The past year has been a tumultuous one for the Powder River Basin. Bankruptcies of some of America’s biggest coal mines have shaken the faith that coal’s behemoth economic drivers will be around forever. Cloud Peak Energy and Blackjewel LLC seem to have clawed their way through bankruptcy but are now controlled by unknown newcomers to the basin. Nearly every major coal mine in Montana and Wyoming has had an ownership change in the last five years, as have many others in Utah and Colorado.

Coal mining in the U.S. has been declining since its peak in 2008, and production from the Powder River Basin has dropped by nearly a third as customers have shut-down as a result of competition by cheaper renewable energy and natural gas-fired electricity. Now, these new companies have emerged to vie for ownership of giant strip mines well past their economic prime.

Most newcomers have paid a pittance to take control of large but economically marginal coal strip mines. In some cases, mine owners have even paid new companies dozens of millions of dollars to take over mines. Why? Every strip mine in the country is facing extensive mine cleanup that must be completed after mine closure, and very few are bringing in significant income.

WORC set out to investigate what the western coal industry’s continued decline means for cleanup of the hundreds of square miles of coal mines that stretch from North Dakota to Navajo Nation. As long-time coal companies are replaced by unknown firms without track records in the region, what has happened to the companies guaranteeing mine cleanup?

Mine Cleanup Funds are Guaranteed, Usually

Coal companies are required by law to post reclamation bonds with regulators as collateral for full mine cleanup. The bonds provide emergency funds to finish reclamation, or mine cleanup, if coal companies go broke and abandon their mines. Reclamation bonds must be maintained throughout the life of a coal mine, and are released back to the mine operator as regulators verify successful reclamation. This is done to incentivize coal companies to perform reclamation as they mine.

Reclamation bonds must be secure, liquid, and reliable because there are more than 200 square miles of unreclaimed coal mines across the West. Many coal-producing states’ budgets are already under stress as coal revenue declines. The distress would only be compounded by having to pay to clean up massive strip mines: the total dollar amount for all reclamation bonds for coal mines in these states is just over $3.9 billion. The largest mines carry bonds in excess of $400 million.

The Three Types of Reclamation Bonds

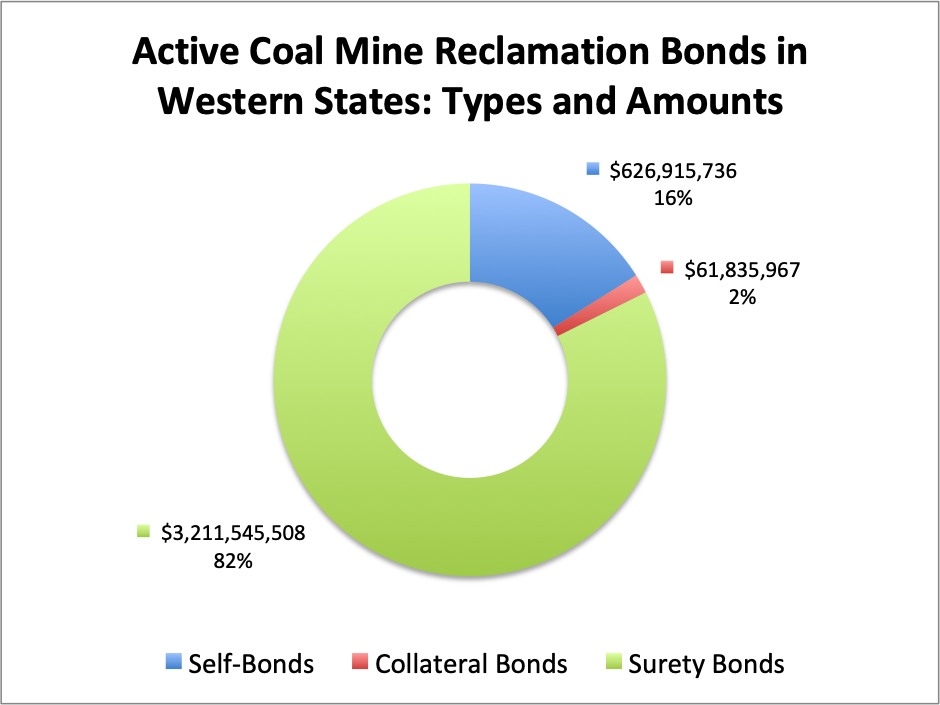

There are three main types of reclamation bonds. Each comes with different risks and provides a different level of security to regulators and the public.

- Surety bonds: The vast majority of bonds are in the form of contractual promises issued by a third-party surety company. If the mine operator fails to complete reclamation, the state agency will demand prompt payment of the full bond amount from the surety company. Given the substantial amount of reclamation that remains to be completed, the total value of some surety companies’ underwritten bonds is hundreds of millions of dollars. Surety bonds account for 82% ($3.2 billion) of active coal mine reclamation bonds in western states.

- Self-bonds: Some states allow a coal company to promise to fulfill its reclamation obligations without posting meaningful collateral by using self-bonds. Self-bonds are essentially an “IOU” from coal companies that are deemed “too big to fail.” But when a self-bonded coal company goes bankrupt, state regulators could be left holding the bag for hundreds of millions of dollars of mine cleanup costs. Self-bonds also undermine the purpose of reclamation bonding: because the company has pledged no assets, no collateral can be returned to a self-bonded coal company if they reclaim their mines, removing any financial incentive to perform reclamation. Self-bonds account for 16% ($627 million) of active coal mine reclamation bonds in western states, but this amount fell by about 78% from three years previous, as WORC has documented in its 2018 publication Now is the Time to End Self-Bonding.

- Collateral bonds: a coal company may put up real estate or personal property to back reclamation. If the appraised value of the property is higher than the price for which the property can be sold, however, states that seize the collateral to pay for reclamation will not have sufficient funds to complete reclamation. Collateral bonds account for 2% ($62 million) of active coal mine reclamation bonds in western states.

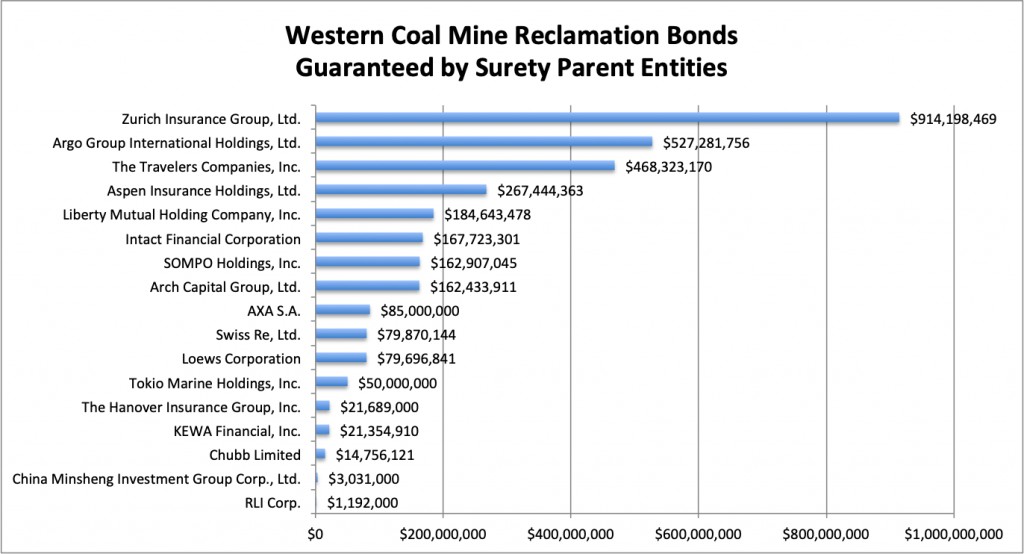

Most reclamation bonds are backed by sureties

As of July 2019, the vast majority of western coal mine reclamation bonds are guaranteed by surety companies. The six largest underwriters of western coal mine surety bonds are responsible for 79% of the total surety bonds written. Zurich Insurance Group guarantees the largest amount in surety bonds, with almost $1 billion in sureties written.

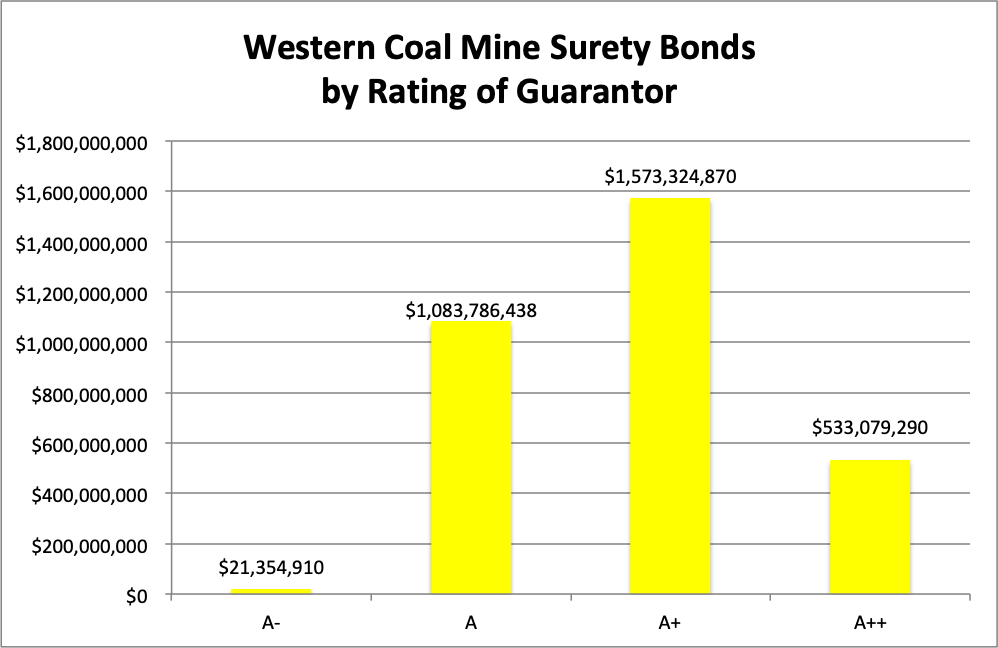

Surety companies that have underwritten western coal mine reclamation bonds are rated between A- and above by A.M. Best Company, which rates the financial strength of insurance companies. Encouragingly, 17% of surety bonds underwritten by companies with the highest possible A++ rating.

In addition to a company’s rating, A.M. Best issues a rating’s outlook based on financial and market trends. The opinion outlook options are negative, stable, or positive. None of the surety companies with reclamation bonds in western states received a positive outlook, but all but one received a stable outlook. KEWA Financial, Inc. is the lone company with a negative outlook, and is also the only company with an A- rating, accounting for the $21 million of surety bonds rated A-.

Risk Grows as the Face of the Coal Industry Changes

In recent years, major coal companies have filed bankruptcy and dumped many of their least profitable mines to financially weaker companies. These sales have allowed better capitalized companies, who are able to pay for reclamation, to dispose of uneconomic coal mines needing significant cleanup. The risk that the new owners will fail increases as demand for coal continues to decline each year.

In light of the increasing risk that state regulators will manage the cleanup of massive western strip mines, it is encouraging that the majority of reclamation bonds are today backed by highly-rated global insurance firms. The importance of secure, liquid, reliable reclamation bonding has never been higher.

Although surety bonds are more protective than other forms of reclamation bonding, regulators must be vigilant to only accept surety bonds from solvent companies. If reclamation of an abandoned coal mine is backed by a surety company that is unable to pay the full cost of reclamation or refuses to pay, state regulators will come up short of funds.

The coal industry’s ongoing decline may well lead larger, better-capitalized surety firms to exit the coal industry. If western coal mine sureties undergo a transition from blue-chip firms to unknown and more poorly capitalized companies, the residents of western coal-producing states will increasingly bear the risk of paying for coal mine cleanup.

Raising public funds to cleanup strip mines will also require political will, which may well delay reclamation. In the meantime, neighboring farmers and ranchers will face the impacts of unreclaimed mine lands, such as degraded water quality, dust, and the extended loss of local agricultural land.

The decline of coal is already shifting the burden onto agricultural landowners to pay for the coal industry’s declining tax base. Asking residents of coal country and coal-producing states to pay for cleanup of the coal industry’s mess is fundamentally unjust after the coal industry made decades of profit from coal mining.

If reclamation is backed by solvent surety firms, it will allow state regulators to spring into action, putting a coal mining workforce back to work restoring diverse and healthy ecosystems for native wildlife and plant species that will support future agricultural use. It is imperative that the public in coal-producing states can trust the solvency of reclamation bond guarantors.

Watchdog organizations will remain involved in coal company bankruptcy proceedings, bond release and transfer processes, and monitoring changes to surety company financials to avoid states and local governments being forced to pick up the tab to clean up the coal industry’s mess.

Want to learn more about surety bonds and reclamation bonding? Have a question about the data? Contact Dan Cohn, WORC Regional Organizer, at dcohn@worc.org.

Full descriptions of A.M. Best’s ratings and other information about this rating system are available on the company’s website, see www.ambest.com.

Data included here is current as of July 2019, and reflects reclamation bonds for coal mines in the states of Colorado, Montana, New Mexico, North Dakota, Utah, Wyoming, and the Black Mesa region of the Navajo and Hopi nations in Arizona. To simplify the data, the below charts aggregate surety bonds by ultimate parent entities of surety and mining companies.

Read more stories about coal here.

Learn more:

Blackjewel’s Messy Bankruptcy In Wyoming Is A Cautionary Tale For North Dakota

Don’t Let Troubled Companies Leave Wyoming On The Hook For Coal Mine Cleanup

Fixing Abandoned Mine Sites Is Essential For A Transition Economy

Help create a healthy and sustainable West. Support WORC today.