New WORC report shows that self-bonding for coal mines can end now.

While most states have long since ended self-bonding, a few hold-outs remain across the west, including Wyoming, North Dakota, New Mexico, and Colorado. WORC’s new report, Now is the Time to End Self-Bonding, establishes that there has never been a better time for regulators in those hold-out states to reduce taxpayer risk by drastically limiting or ending self-bonding.

Self-bonding is a promise from a coal company to pay for required coal mine cleanup, or reclamation, not backed by any collateral. The risk that states face is if a coal company liquidates before reclamation is complete, the self-bond becomes nothing more than an uncollectable “IOU” leaving the public on the hook for the clean up.

“Self-bonding is risky to taxpayers and unnecessary to coal mining companies,” said Bob LeResche, a WORC Board member from Clearmont, WY. “The GAO recommends ending self-bonding outright, and our report demonstrates that would not harm the industry. Self-bonding could be ended tomorrow and no one would blink.”

There are several reasons why ending self-bonding wouldn’t hurt the coal industry. In 2015 and 2016, the three largest coal companies in the country filed for bankruptcy, owing $2.3 billion in self-bonds to state coal regulators. WORC and Powder River Basin Resource Council led an intervention into the bankruptcy proceedings to force Alpha Natural Resources, Arch Coal, and Peabody Energy to replace their self-bonds with third-party insurance instruments.

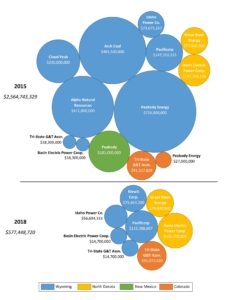

That effort culminated in wholesale replacement of $2.5 billion of self-bonds, including by Cloud Peak Energy, which voluntarily replaced its self-bonds outside bankruptcy court.

With these three behemoths using other financial instruments to ensure their reclamations, self-bonding has hit historically low levels. There are only $577,448,720 in self-bonds outstanding in western states today, down from $2,564,743,329 in 2015.

Surety bonds, conventional alternatives to self-bonds, are available on affordable terms to the coal industry, according to coal company investor disclosures and court filings.

This suggests that replacing the remaining western self-bonds could be done with minimal impact. The coal companies that remain self-bonded have good credit ratings, which suggests they can replace self-bonds with affordable conventional bonds.

A study from GAO found that, among natural resource extraction industries, self-bonding is only available to the coal industry. This special treatment isn’t befitting an industry with such massive and expensive impacts on land and water. Senator Maria Cantwell (D-WA) has sponsored federal legislation during the 2018 session aimed at eliminating state self-bonding in an effort to protect coalfield communities.

With hundreds of millions of dollars in reclamation costs hanging over taxpayers, and plenty of other options for companies to bond, it doesn’t make sense for state regulators to gamble on the promises of the coal industry. The time to end self-bonding is now.

Sign up for WORC blogs

Receive notice of new blog posts by signing up here.