These four tax-collection reforms could save Wyoming counties millions in unpaid taxes.

Written by Bob LeResche, vice-chair of Powder River Basin Resource Council.

When the Coalbed Methane industry went belly up in Wyoming, that bust was hard not only on gas field hands and construction workers, but also on Wyoming’s counties and Wyomingites who rely on their county government for basic civil services like education, transportation, public health, public safety, and others. Counties in our energy colony depend greatly on tax revenues from production of oil, gas, coal, uranium and other minerals. These ad valorem tax revenues – based on the value of produced minerals – are collected twice a year, but one to two years arrears – long after the minerals have been produced and sold, and the producers have pocketed the money. When a mineral producer goes out of business, millions of dollars in taxes are left unpaid, and counties are in a real bind to provide needed services.

During Powder River’s work on the bankruptcies of Peabody, Arch, and Alpha – the three largest coal mining companies operating in Wyoming – we intervened with the Western Organization of Resource Councils in bankruptcy proceedings to ensure that money and bonds set aside for reclamation would not be looted or spent on other things. And it came to our attention that tens of millions of dollars of ad valorem mineral taxes have gone unpaid over the years by coal, oil & gas, and uranium companies.

State law grants an average 18-month “float” on mineral company debt to counties. And in the event of bankruptcies, the counties stand at the rear of the line to collect, behind bankers and all secured creditors.

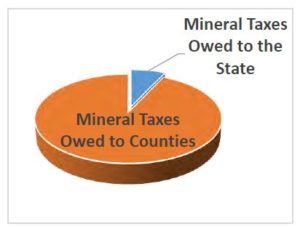

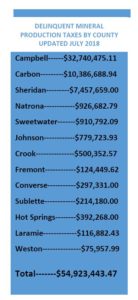

In collaboration with county treasurers, we produced two reports, which have been distributed to legislators and reported upon widely. The reports show that more than $54.9 million of ad valorem mineral taxes were owed to 13 Wyoming counties in July of this year. (Since then, Westmoreland Coal’s bankruptcy filing involving the Kemmerer mine has left Lincoln County, Wyoming, unsure of whether they will ever see money owed them for mineral production during the past 18 months.)

“More than $54.9 million of ad valorem mineral taxes were owed to 13 Wyoming counties in July of this year.”

Long float and lack of secured standing in bankruptcy court make collection of these taxes very difficult, and often impossible. Worse, in many cases, uncollected ad valorem taxes represent a large portion of revenues our counties need every year for critical county services. And these are services already received by the companies that owe the taxes and already paid for by the counties 18 months before.

We are urging the legislature to pursue four solutions to fix this problem:

We are urging the legislature to pursue four solutions to fix this problem:

- First, the legislature should shorten the float period. They should convert the 18-month arrears schedule to match that of severance taxes paid the state on the same mineral production. State taxes are paid monthly, 55 days arrears, in contrast to ad valorem taxes, which are due and payable to counties only semi-annually, an average of 18 months arrears. If county taxes were paid more currently, counties would not be out so many millions of dollars when bankruptcies occur.

- Second, the legislature should establish a tax lien on mineral production, similar to the tax liens counties hold on real property such as homes. Many states do this. A lien would put Wyoming counties near the head of the line to receive payment in case of bankruptcies – at least equivalent to the status of secured creditors.

- Third, the legislature should consider a fund Wyoming counties could draw on to finance legal assistance in bankruptcy court. These proceedings are arcane and expensive, and many counties cannot afford the outside counsel that is required to have any chance of eventually collecting what they are due.

- Finally, the legislature should direct and empower the Oil and Gas Commission and the Department of Environmental Quality to withhold permission to transfer leases or operating permits until taxes have been paid on all previous production.

- The lien provision – a back-end fix – was passed 54-6 in 2016 by the Wyoming House, but was never presented for a Senate vote, presumably because of opposition from the banking industry.

The monthly payment plan – the best front-end fix – was drafted as a bill this summer and considered by the Joint Revenue Committee in late November. The draft delays conversion to the new schedule until 2022 and provides a 10% discount when taxes are brought current, both to lighten the temporary burden of coming current on a monthly payment schedule. Sadly, the committee rejected the draft bill 9-4 after hearing objections from mineral companies who implied their 18-month “float” is necessary to keep them economically “afloat.” According to press reports, however, both committee members and industry representatives endorsed the back-end (lien) fix.

“Individual taxpayers, whose taxes carry county liens, and most of us who pay our property taxes monthly into escrow accounts required by lenders, deserve at least parity with industry.”

Powder River will continue to urge legislators to fix this problem during the coming session. Given the trajectory of coal markets, things will likely only get worse. Individual taxpayers, whose taxes carry county liens, and most of us who pay our property taxes monthly into escrow accounts required by lenders, deserve at least parity with industry. It’s only fair. Mineral companies may be the foundation of our economy for now, but an excessive “float” on their public tax obligations at our expense certainly can’t really be the key to their survival in the market. It is no more than another hidden and unnecessary subsidy to the minerals industry.

Read more coal stories here.

Related stories:

WORC Takes Zinke’s Royalty Policy Committee to Court to Stop Blatant Corporate Giveaways

New Report Shows Coal Reclamation Benefits Taxpayers and Creates Jobs

WORC Interns Take Flight with the Task of Reporting on Coal Mine Reclamation